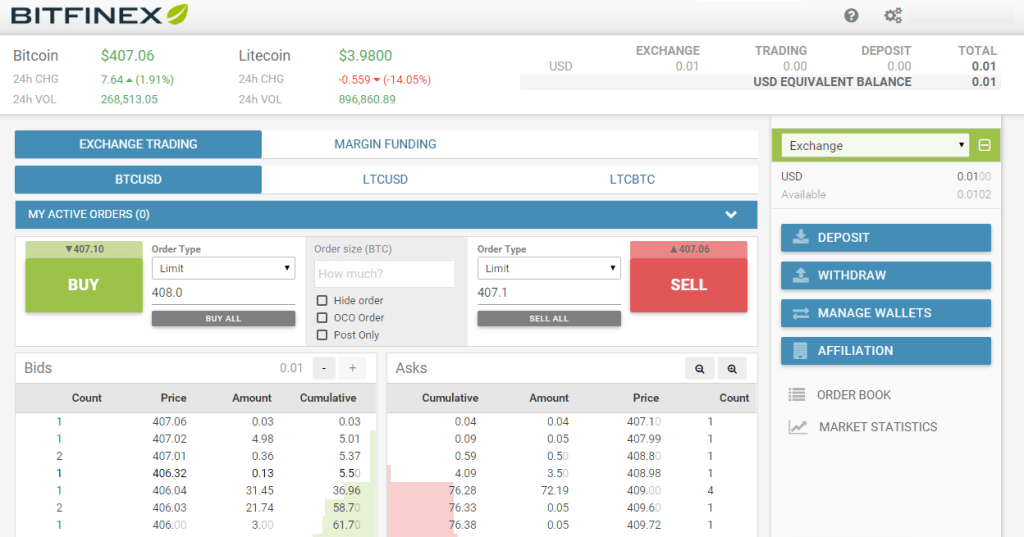

Bitfinex.com is one of the oldest and most popular bitcoin trading exchanges in the world. They have developed an excellent user interface that makes navigating your account near euphoric experience. Utilizing the latest in 2-factor authentication technology and a sophisticated cold storage system to keep all user funds safe, Bitfinex is well known as one of the most trusted bitcoin exchanges. They are also the safest place to margin trade bitcoin since they have high liquidity in their orderbook and cap your leverage to 3.33x

Their advanced interface makes it easy to:

- manage your orders for several trading pairs with 1 click

- transfer funds between all your wallets

- deposit trading funds four different ways

- Long, Short, or Hedge Bitcoin

- Refer your friends to earn money and get them a discount

- be a liquidity provider, lend your funds to margin traders and earn daily interest while you are not trading

- have your withdrawals processed instantly after two factor authentication

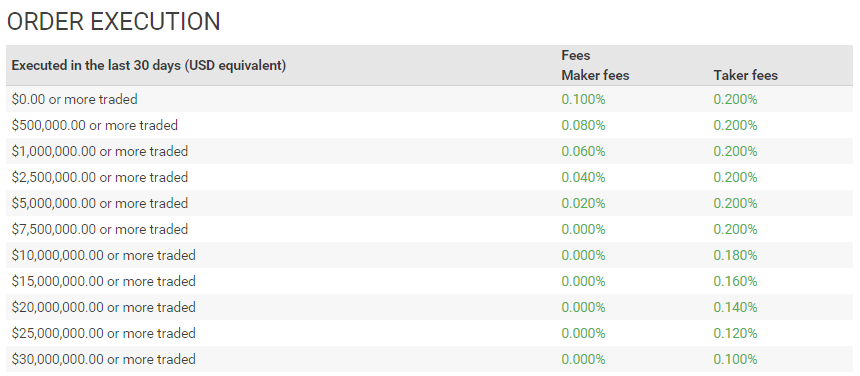

Bitfinex has a maker-taker fee schedule which gives a discount to the trade who opened his order first. They also offer discounts for high volume traders. Both of these features contribute to and encourage liquidity in their order books which helps provide a better and more efficient trading experience for all users.

Bitfinex Trading Fees

Bitfinex 10% Discount Code: iJEOS8Lrjo

Bitcoin Margin Trading

Bitfinex margin trading feature lets you use funding from peer-to-peer margin funding providers to trade bitcoins and litecoins. You are always responsible for the accrued margin funding fee, at the rate in effect for the margin funding involved in each position you take.

For example, let’s say you want to open a long position for 10 bitcoins. That means you want to buy 10 bitcoins hoping the price will go up. The system will borrow for you 10 * the price of Bitcoins in US dollars (let’s say 2,500 USD, 10 * $250) from margin funding providers, at the best rates available. When you close your position, you will reimburse the 2,500 USD plus the funding fees that have accrued. Margin funding fees are added to your balance once per hour.

There are two ways to pay the margin funding fees (the “margin funding type”):

- Daily: Every day around 01:30 UTC the margin funding fees that have accrued to your position will be debited from your “trading” wallet.

- Term: Margin funding fees will accrue every day into the funding balance of your position until you close it.

At any time, you can close your position. This will reimburse your lender, and your position will be settled either at a profit or a loss, according to the price at which you close your position. The same goes for a short position, where you borrow bitcoins or litecoins instead of dollars. If there is no margin funding provider available, you will not be able to open a position. Your order status will be cancelled with a status indicating “NO RESERVE”.

The Trading Wallet is used for margin trading. It cannot be used for buying or selling bitcoins or litecoins for the purposes of deposit or withdrawal, that is, all positions that are opened must be closed to unlock the P&L and the underlying collateral. Balances in this wallet are collateral to cover for potential losses that may occur. If losses mount and you overall net balance goes below the maintenance requirement, your position may be force-closed to avoid further losses.

Learn more about bitcoin margin versus derivatives trading.